what is the property tax rate in ventura county

Prop 13 Maximum 1 Tax. The Property Tax Rate for the City and County of San Francisco is currently set at 11880 of the assessed value for 2014-15.

Reelected Incumbent Cheryl Heitmann Is Quoted In The Ventura County Star Saying The Fact She And Weir Were Re Elected Signal Ventura Measurements Supportive

Please note that the above Property and Sales tax rates are subject to change and may have changed since publication.

. Find All The Record Information You Need Here. Thousand Oaks Newbury Park and Westlake. All emailed material must be from the owner authorized agent CPA or an officer of the organization.

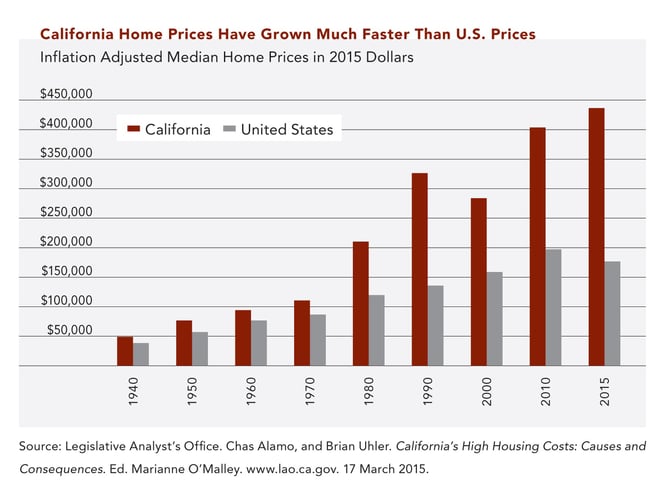

The average effective property tax rate in California is 077 compared to the national rate which sits at 108. Californias overall property taxes are below the national average. The Ventura County sales tax rate is 025.

A phone number must be included for verification purposes. Our fax number is 805 645-1305. This is the total of state and county sales tax rates.

10400 City Property Tax Rate Thousand Oaks includes Newbury Park and Ventura area of Westlake Village 10400 Westlake Village LA. At the same time tax liability switches with the ownership transfer. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

The Ventura County sales tax rate is 025. When buying a house ownership is transferred from the former owner to the buyer. In addition the property tax rates for particular portions of a city may differ from what is above due to specific Tax Rate Area.

The median property tax also known as real estate tax in Ventura County is 337200 per year based on a median home value of 56870000 and a median effective property tax rate of 059 of property value. This is the total of state and county sales tax rates. Tax Rates and Info - Ventura County.

What is the property tax rate in Ventura County. Ventura County has one of the highest median property taxes in the United States and is ranked 123rd of the 3143 counties in order of median property taxes. Ventura County California sales tax rate details The minimum combined 2021 sales tax rate for Ventura County California is 725.

The median property tax on a 56870000 house is 335533 in Ventura County. The average effective property tax rate in San Diego County is 073 significantly lower than the national average. Ad Unsure Of The Value Of Your Property.

The assessed value is. The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700. Thousand Oaks includes Newbury Park and Ventura area of Westlake Village 10400.

This is the total of state and county sales tax rates. The Property Tax Rate for the City and County of San Francisco is currently set at 11880 of the assessed value for 2014-15. County 11063 Agoura Hills 11063 Oak Park 11642.

Its probably safe to assume that the actual tax rate for each area will be closer to 125 give or take. Customarily whole-year real estate taxes are paid upfront at the beginning of the tax year. Revenue Taxation Codes.

Tax Rate Database - Ventura County. With that who pays property taxes at closing while buying a house in Ventura County. Ventura County collects on average 059 of a propertys assessed fair market value as property tax.

Tax description Assessed value Tax rate. What is the real estate tax in California. The California state sales tax rate is currently 6.

However because assessed values rise to the purchase price when a. Uni SCH Bond Oakpark 2. Uni SCH Bond Oakpark 3.

What is the property tax in Thousand Oaks CA. The median property tax on a 56870000 house is 597135 in the United States. All forms must contain a photocopy of an original signature.

The minimum combined 2020 sales tax rate for Ventura County California is 725. The median property tax on a 56870000 house is 420838 in California. Uni SCH Bond Oakpark 4.

The California state sales tax rate is currently 6. The combined 2020 sales tax rate for Ventura County California is 725. Ventura County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property.

SEE Detailed property tax report for 5796 Freebird Ln Ventura County CA. The assessed value is initially set at the purchase price.

Property Tax California H R Block

California Government Benefitting From Rising Property Values Low Rates And Higher Home Values Increase Property Tax Collections Who Pays Tax Bill On Foreclosed Properties Dr Housing Bubble Blog

Real Estate Refresher Helpful Tax Provisions In California And Beyond

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

States With The Highest And Lowest Property Taxes Property Tax States Tax

Ventura And Los Angeles County Property And Sales Tax Rates

Property Tax By County Property Tax Calculator Rethority

When We Reach Retirement Age A Lot Of Us Plan To Move To That Dream State We Always Pictured Ourselves Growing Old Gas Tax Healthcare Costs Better Healthcare

The Property Tax Inheritance Exclusion

Ventura And Los Angeles County Property And Sales Tax Rates

California Public Records Public Records California Public

Property Tax By County Property Tax Calculator Rethority

Iowa Legislature Factbook Map Of The Week

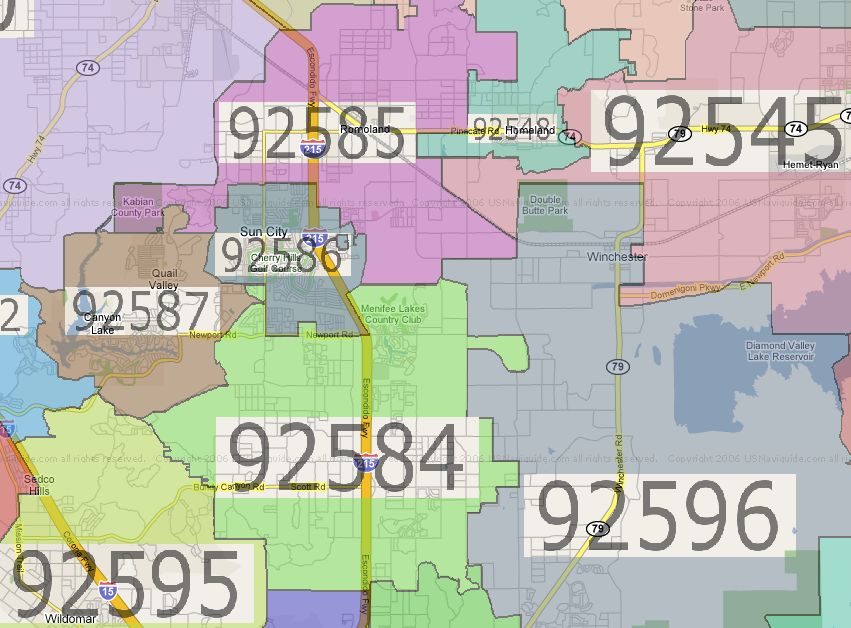

Property Taxes By Zip Code No Only By County

Property Tax By County Property Tax Calculator Rethority

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Property Tax Illinois Tax

Ventura County Ca Property Tax Search And Records Propertyshark

Ventura County Ca Property Tax Search And Records Propertyshark